Imagine the shock of discovering that your wedding venue has unexpectedly shut down, your photographer is a no-show, or your "designer" gown is actually a shoddy counterfeit shipped from China. These scenarios are more common than you'd think, leaving couples financially (and emotionally) devastated in their wake. Here's what to do in case the unthinkable happens, as well as precautions you can take to safeguard yourselves in the first place.

By: Stefania Sainato

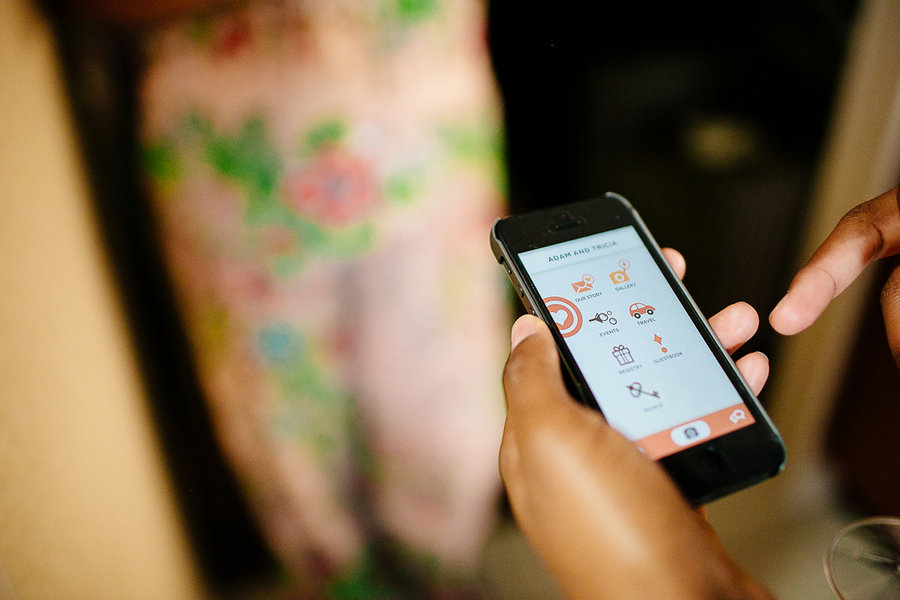

Photo Credit: Infinite Pixels by Angel Photography

What to Do When a Venue Shuts Down or a Vendor Doesn't Show Up

Mark Schondorf, Attorney at Hecht & Seidman, LLC:

"If a couple doesn't have the real contact information or identity of a vendor, they can try to have the charge canceled or reversed by calling their bank. If they submitted a check, then the account number should be available online, depending on the bank. A lawsuit will allow the party to subpoena such bank records to try and track the fraudulent party down. If they are an entity, such as an LLC or a corporation, the Secretary of State will usually have some identifying information in paperwork that has been filed, sometimes on the state's website.

A couple can initiate a lawsuit for a breach of contract (which means that the vendors didn't do what they were supposed to do) or fraud (they took your money and never intended to do the work at all). They can either hire an attorney or try to file a lawsuit themselves. In some states, attorneys aren't allowed in small claim cases. Consult the court in the county where the agreement was made or supposed to be performed, which will often have self-help assistance on how to file a claim without an attorney.

Gather as much documentation as possible, including all communications with the vendor from the very beginning. Print out emails and save text messages as screenshots. Couples should also retain a copy of all promotional items (websites, brochures, advertisements, etc.), which will help prove the misrepresentations made. Most importantly, all documents showing the financial transactions between the parties (i.e. bank records, receipts, and canceled checks) will be vital to any claim.

The length of the process depends on the allegation amount, the system the court has in place, and whether or not the fraudulent contractors respond to the lawsuit. Some states, like California, have a small claims process that resembles what you would see on a TV judge show. The evidence rules are relaxed: You get one shot to show up and present your case, and a judge will make a decision rather quickly. This process can take anywhere from a few weeks to a couple of months, whereas a full-blown lawsuit (usually more than $10,000) can take well over a year. If you win, you'll get a judgment, which you then have to collect on, but how long it will take to turn that into monetary compensation depends on whether the fraudulent contractor has any funds they can seize."

Cody Emerson, Attorney at Emerson Law:

If the couple hires a vendor/supplier to perform a service or provide some product, and they back out at the last minute (or at all), forcing the bride and groom to hire another company, then they could potentially recover the difference in cost between the breaching contractor and the replacement. For example, if the vendor was contracted to provide tables and chairs for the wedding, and they call the week before to inform the couple they will be unable to do so, then they would have to rush to find a backup supplier who could provide the same quality and type of goods. If the couple is charged with a $500 rush fee, that then's something they could also recoup from the breaching vendor.

If the vendor just never showed up, then the bride and groom would need to provide testimony — along with other people from the wedding — stating that the company failed to honor their contractual agreement. You would also need the new contract to show the replacement price paid to the backup vendor.

Also, some contracts have an attorney's fee provision stating that the prevailing party in any litigation under the contract will be entitled to have their legal fees paid by the losing party. So, the couple could potentially recoup their attorney's costs if they prevail in the case.

What to Do if You're Unsatisfied With the Product or Service

Cody Emerson, Attorney at Emerson Law:

"The legal path that couples need to take depends on the nature of the contract, but generally, they would be filing a small claims action (if the contested amount is less than $5,000) or a complaint in Circuit Court for breach of contract. They would be suing to recover all of the money they expended. If the bride and groom did receive some service from the vendor/supplier, then the other party could potentially file a counter-petition for a set-off, requesting the amount be reduced by the value of the services provided. If the couple used or kept non-conforming goods, then the vendor could ask for a set-off in this case as well.

If a couple is unsatisfied with a product, they should immediately contact the supplier in writing to express their dissatisfaction and request a refund. I dealt with a situation where a couple ordered about 300 decorative plates as party favors for their guests. It cost my client about $250 just to have the package shipped to them. When they contacted the vendor, they were willing to issue a refund but refused to pay for the return shipping. However, the product they received was non-conforming to what they had ordered — the color of the plates in the pictures was red, but the ones that got sent to them were blue. Therefore, it's considered a breach of the sales contract and, potentially, fraud. The seller should be responsible for 'making the buyer whole' (putting them in the same position had the goods been conforming), thereby covering the cost of shipping the plates back.

In addition to collecting letters, emails, texts, etc. from the breaching vendor/supplier, I always advise clients to take pictures and even video of non-conforming goods. You'll also want to capture photos of the replacement products as well.

A contract dispute case could take anywhere from one month to a year or more. It depends on the litigation, discovery process, and whether or not the vendor/supplier has legal representation. If you can't find a physical body to be served by a process server once the case has been filed, then you could spend ten years looking for someone to sue. The couple should always get up-to-date contact information from a potential vendor/supplier, along with where they are incorporated. You can look up the company's incorporation status online. Most states have a department of business website that allows you to see when it started, who owns it, and the physical address of its registered agent (the actual person you have to serve in any lawsuit against that entity)."

Getting Back on Track With the Wedding Plans

Photo Credit: Lyn Ismael

Dezhda "Dee" Gaubert, Owner of No Worries Event Planning:

"As a wedding planner, I've personally helped brides and grooms deal with vendors in breach of their contract. If you find yourself in an unfortunate situation before the big day, first, take a deep breath and realize that despite what happened, your wedding will still be a joyous event. The sooner you can adjust your mindset back to a positive one, the less likely you'll be to make panicked (and potentially costly) decisions with your remaining vendor bookings. Next, carefully evaluate replacements for the fraudulent contractor, and kindly ask the candidates to lower their fee to compensate for the lost monies with the previous vendor. Sometimes, due to unique circumstances, they will charge less out of a sense of goodwill.

If a fraudulent situation occurs prior to the wedding, and the couple doesn't already have a wedding planner, then I'd refer them to my attorney right away. Unless the planner has a close professional or personal relationship with the fraudulent vendor, there is not much they can do, and they wouldn't have any leverage in the situation since they didn't negotiate the service in the first place.

If something happens on the wedding day itself, then the couple should assign a point person — a bridesmaid or groomsman, or family member — to take notes on the situation. In the case of a no-show, they would call up that vendor and record how many times they call, how many messages they leave, etc. If they need a replacement ASAP, that person can also start making inquiries to get a replacement. For example, if the DJ doesn't show up, I recommend that they contact a large entertainment agency, as they would have several DJs on board they can call in at the last minute.

If the vendor's work is unsatisfactory, that point person should discuss the problem with them, record the time it occurred, and lay in place the damages that will be paid (e.g. a partial refund of their fee). For example, if the DJ used faulty speakers, then they could even record the music on their phone to prove the issue. The couple should send a follow-up in writing immediately after the wedding to pursue the damages, along with a list of what happened, and when. I once worked with a caterer who nearly destroyed one couple's wedding with delayed and undercooked food. He violated the venue code by leaving trash, along with many other issues. I believe he marketed himself as a caterer when he wasn't capable of the job. I took numerous photos of the offenses in question and wrote a six-page memo with timestamps of the issues for my clients to take with them to small claims court. I'm not sure if they received any monies back, but they certainly had plenty of information and documentation to pursue seeking damages.

There are also times where you can receive damages on the same day as the event, too. At one wedding we coordinated, the venue did not provide the couple with the bridal suite they were promised and were late setting up the room, despite the fact that I kept nagging them constantly. We pointed out where they breached their agreement multiple times, and negotiated $500 off the bar bill that very night. (Having a wedding coordinator or planner in place will ensure any issues are recorded and followed up upon; it's a lot to ask a valued guest or friend to do this for you on the day of, and said person could get distracted with the festivities at hand.)"

What to Consider When Hiring Vendors

Photo Credit: Fotowerks Custom Photography

Dezhda "Dee" Gaubert, Owner of No Worries Event Planning:

"Book vendors with years in the business and lots of connections and referrals. For example, if you meet with a DJ and he or she happens to know your florist, that's a good sign. They're interconnected with the wedding world in your area and thus have a reputation to protect. Venues routinely work with legit, reliable, above-board vendors, and are great resources for referrals.

Ask if a vendor has business liability insurance and a business license. You can even ask for proof of this before hiring them!

'All inclusive' vendors that provide the venue, catering, florals (the whole shebang) may be a good value, but you may not have a lot of say in the various details involved and not be able to have control over the specifics. Ask "turnkey" vendors to describe in great detail what you get for the money, in itemized form. For example, the itemization for flowers would state the size and nature of your centerpieces, how many you'll have, and how much it would cost for various options should you change your mind about the look and style of the florals."

"The client should read the terms of the vendor contract thoroughly and ask questions to eliminate any confusion they may have. It is important for clients to know the details of the total cost by requesting an itemized list from the photographer before signing a contract. There should be a solid understanding of the deposit amount and its due date, the balance and its due date, overtime fees in case the event continues later than scheduled, and the photographer's cancellation and refund policy. Knowing the specifications of what you are paying for is essential to hiring a professional so that you aren't overcharged.

Brides and grooms should request business references before hiring a photographer. A well-established wedding photographer should be able to provide a list of wedding events they've worked on and contact information for recently-married couples that can speak to the level of experience the company possesses. You only have one opportunity to capture astonishing wedding photos, so hiring a professional who knows how to get those photographs in a fast-paced agenda is essential.

Couples should know who their photographer(s) are scheduled to be on their wedding day. Arguably, this often-overlooked detail is among the most important. Just because you see some beautiful wedding photos on the company website, does not necessarily mean the same photographer will be shooting your wedding. Photographer's styles vary greatly, so always confirm exactly who will be on the other side of the lens during the wedding."

Mark Schondorf of Hecht & Seidman, LLC:

"Vendors with a lot of positive reviews on sites like Yelp or Google Plus help vouch for a vendor, but be careful. Make sure that there are a lot (i.e. 20+) positive reviews and that the reviews are not clustered in time (i.e., within a two-month period), lending more credence to their accolades.

If the vendor is a LLC or Corporation, look them up on your Secretary of State website and find out when they were formed. If your state identifies officers of the LLC or corporation, research those people or other entities they owned. Scam artists will often start a company, and when they are found out, they'll just create another one. There may be bad reviews of those old companies, which can clue you into whether a vendor is legitimate.

Do not pay everything upfront. Try to schedule payments in chunks as the date nears or the work progresses. Pay with a credit card when possible, and if not, then a check. Do not pay cash as an initial payment, and certainly never without a receipt. And if someone requires they be paid by gift card, run away.

Make sure everything is pursuant to a written agreement, and that you get a signed copy. Also, try to communicate as many of the important points in writing, such as e-mail or text message. If you and the vendor decide to change something after an oral conversation, whether it's on the phone or in person, then follow up with an e-mail memorializing the change. If the vendor doesn't object in writing, this can be a huge help if there is a problem down the road."

What to Consider When Purchasing Your Wedding Gown

Steve Lang, CEO of Mon Cheri Bridal and President of the American Bridal and Prom Industry Association (ABPIA)

"Today’s bride should be extremely cautious when ordering wedding attire from a website she is unfamiliar with, as there are numerous counterfeit sites that display designers’ images as their own but do not deliver products of the same caliber. The best thing to do to ensure that the gown is authentic is to visit a local authorized retailer where she can see the dress sample in person and try it on before she places her order.

If the dress of her dreams isn't available in local stores and the bride decides to order it online, she should thoroughly research the website first. Some research ideas include finding out if the website has a legit brick and mortar store location, calling the phone number listed (if available), reading the about us section and the website’s return policy, and searching for consumer reviews. A majority of counterfeit websites don't list an address or a customer service phone number, and many are riddled with typographical and grammatical errors.

The unauthorized use of designers’ copyrighted images leads consumers to believe they are purchasing an authentic designer wedding dress for a fraction of the cost. Be aware that most manufacturers have minimum retail price guidelines that their retailers must follow — if a website advertises a $1,200 gown for only $250, then that's a huge red flag. Most brides who order from counterfeit websites aren’t aware that they ordered a fake design until the dress arrives, and at that point, it is often too late for a return or refund.

Counterfeit dresses often arrive in tiny packages with the dress compressed into an unrecognizable heap. Once unpacked, counterfeit dresses rarely resemble the design originally pictured. They often feature sub-quality fabrics, poor embroidery, cheap plastic beads, and colors that don't coordinate.

By the time a consumer realizes they've been deceived, the counterfeit website may no longer exist online. Emails and phone messages requesting a refund will likely go unanswered. Consumers who believe that they may have received a counterfeit dress are encouraged to reach out to the website in question (if their contact information is provided) and file a dispute with their credit card provider. Victims of this crime are also encouraged to share their stories with the public to help spread the word about this worldwide epidemic. Counterfeit websites can be reported to the American Bridal and Prom Industry Association (ABPIA) at [email protected]."

What to Consider When Purchasing Your Engagement Ring

Dan Moran, Owner and President of Concierge Diamonds:

"Work with a reputable jeweler. You want to make sure that the person you're working with has some kind of background and experience. They should also have some kind of certification, whether that's a certified diamond grading course from CGS or a GG from GIA. You want someone who can look at a stone on your behalf and be a proxy for your eyes.

One of the best ways to spot a fake diamond is to do the line test. Draw a line on a white sheet of paper. Now take your loose diamond and turn it upside down on top of the line, and look through the stone at the line. If you can see the line, it’s probably a fake diamond. If you can’t see the line, then you have a real diamond. The reason for this is that a diamond would bend the light so sharply that you wouldn't be able to see the printed line under the stone.

“With the recent reports of even large retailers being caught swapping the diamonds in their customers’ rings for fakes, jewelry theft is more prevalent than most people realize. You personally need to be familiar with your stone. The inclusions in your stone are unique, like a fingerprint. If your diamond was certified or you had it appraised, then you can consult that certification against the stone you bought, versus the stone you received back. If they don't match, then you have a cause for complaint. You can also check the diamond plot on your certificate and see if the inclusions match.

If this doesn't work, then take the issue up with the Better Business Bureau or jewelry industry associations like JCK, where you can essentially get a jeweler blackballed. Diamond dealers like myself won’t work with anyone who has this kind of cloud over them. You also have to think about how you can protect the next person from becoming another victim."

Safeguarding Your Investment

Photo Credit: iStockphoto

Todd Shasha, Managing Director, Personal Insurance Product Management at Travelers Insurance:

"Protecting your investment with wedding insurance is a must. According to Travelers Insurance data from the past five years, venues are the costliest wedding insurance claim, accounting for 64 percent of all paid claims involving vendors. Wedding insurance policies also provide coverage if a vendor goes out of business or simply fails to show up, reimbursing you for any lost deposits or unexpected expenses you would have to incur to avoid cancellation or postponement of the wedding. For example, if a caterer or transportation company suddenly becomes unavailable for your event, and you can find a last-minute replacement, this coverage can help reimburse you for the difference in cost compared to the original contract."

Ben Woolsey, President and General Manager of CreditCardForum.com:

"It's advisable to put vendor charges on a credit card, as many offer zero liability for unauthorized purchases should card information get compromised or fraudulently used by a vendor. Many cards also offer additional coverages that allow for refunds for purchased products or services that do not meet the buyer's satisfaction. Some even offer trip cancellation insurance should a destination wedding or honeymoon need to get canceled. Since weddings can be quite expensive, it is also advisable to spread the charges across several cards, when possible, to both spread the potential risk and to take advantage of the greater spending limits available with multiple lines of credit.

If fraud does occur and charges were made on a credit card — with services not delivered or card information compromised — then the cardholder should contact the card issuer as soon as possible and file a dispute. Most people are unaware of how much power credit card companies have with resolving customer disputes and matters of fraud, as they have tremendous leverage with merchants who accept their cards. Credit card zero-liability policies by the four major card brands allow for protection up to 60 days from the transaction date. By contrast, debit cards offer a $50 liability limit if the fraud is reported within two business days. After that, the liability goes up to $500 if reported within two weeks, and then unlimited beyond that.”

Comments

Grand Lens Phot... replied on Permalink

Thank you!